ABOUT GOLD

The world’s central banks have been buying gold for years, and that trend could drive the price up over $2,000 next year, according to some experts. The problem is the ever-growing pile of public debt, which could be exacerbated by inflation next year.

Central banks deal with stimulus using gold

Noble Gold founder and CEO Collin Plume told Value Walk in an email that central banks will have to bear to brunt of “government generosity” by covering the costs of the many stimulus packages that have subsidized workers and businesses that couldn’t function during the lockdowns. However, that money will still need to be paid back, which causes three major challenges for central banks.

“They are all struggling with these issues simultaneously, and so borrowing amongst each other is not an option” Plume said. “Unemployment and bankruptcies will mean less tax revenue coming in to balance the books, and inflationary pressures are almost inevitable given the colossal figures involved. All of these realities will likely push prices for everyday household items higher (along with interest rates as well) at a time when people can least afford them – leading to recessionary fears down the line.”

According to Plume, this is the second-highest year on record for gold buying by central banks. He said the trend started to pick up momentum in 2018. This year central banks have already bought 651 tons of gold, and a larger pool of central banks have been buying gold for its diversification benefits. This pushed annual demand from them to its highest level since 1971.

“The most obvious countries adding gold to their reserves included Russia, China, Poland, Turkey, and Kazakhstan, while other countries, such as Poland and Germany, have begun to ‘repatriate’ their gold from other countries where it has been kept for safekeeping,” Plume explained.

Why central banks are buying gold

Plume explained that the main reason central banks want to hold gold is because of the stock-to-flow ratio, which compares the newly mined gold supply, or the flow, with above-ground stockpiles, or stock. He said new gold keeps getting added to the stockpile, amounting to about 1.5% per year. According to Plume, gold has a natural inflation rate of about 1.5%.

“If gold were money, it would be physically impossible to duplicate the rate at which the printing of fiat currency takes place,” he said. “Gold is finite, and as more ‘currency’ is printed, it becomes more valuable. Central banks of course know this, so in anticipation of them stepping up their printing of money, they buy gold to offset this. It comes down to simple supply and demand.”

For this reason, Plume expects the gold price to climb above $2,000 and stay there starting next year. He pointed out that U.S. national debt hit a new high of $27 trillion, which is an increase of almost 36% in less than four years. Plume added that it’s simply unsustainable to keep printing more money.

A year of uncertainty

RBC analyst Christopher Louney also thinks the gold story isn’t over yet. He noted that the gold price tumbled the most in months due to the news about the COVID-19 vaccine, but current price levels still leave plenty of unanswered questions. Louney pointed out that this has been a year of uncertainty which included a pandemic, economic crisis, heightened political tensions and plenty of drivers that have been positive for gold.

Even though the markets have appeared to be buoyant, he doesn’t believe investors have forgotten their fear. Louney added that the dollar has strengthened alongside real and nominal rates, which is bad for gold. However, he doesn’t believe those factors were enough to explain the steep drop in the gold price on their own.

He saw the decline as “a reset of gold-related pandemic expectations, a repricing of stimulus expectations by gold investors, a realignment of inflation fears and a shift in mindset around post-election political uncertainty.” Louney said the reset could have helped gold find a new equilibrium and noted that even after the first shipments of the vaccine, there will still be challenges in distribution and uptake, which means the health crisis won’t end immediately.

He is less positive on the gold price than Plume as he sees a price of $1,893 for next year with a low price of $1,628 and a potential high price of $2,608.

The global economy was flashing danger signs long before the pandemic. For one thing, many countries were clamouring to get hold of as much gold as possible. For the past decade, they have been buying new reserves and bringing it home from overseas storage to an extent never seen in modern times. Then just before the pandemic, there was a pause. What does all this mean?

Central banks added 650 tons to their reserves in 2019, the second highest shift in 50 years, after the 656 tons added in 2018. Before the 2007-09 financial crisis, central banks were net sellers of gold worldwide for decades. Leading the recent spree has been China, Russia, Turkey, Kazakhstan and Uzbekistan.

Venezuela started repatriating its gold in 2011, shipping 160 tonnes from New York. A third of its holdings remain in London, but only because the Bank of England won’t repatriate them – declaring it doesn’t recognise the government in Caracas. Venezuela has now made this the subject of a legal claim.

Between 2012 and 2017, Germany repatriated most of its massive reserve from Paris and New York to Frankfurt. The Netherlands did likewise in 2014, followed by Austria.

Central bankers look set to go on a gold buying binge this year in the wake of the Covid-19 pandemic, new research shows.

And the leading reason for the likely desire to buy bars of bullion is fear of another financial crisis, according to a recent report from industry group World Gold Council.

Central Banks Doubling Down on Gold

The survey showed that 20% of the banks that responded to the survey said their central bank would likely increase their gold holdings, versus 8% of those responding the same question a year ago. That’s more than double the percentage.

Central Banks have been on something of a buying binge recently and the survey results suggest they could gobble up even more of the yellow metal. Such banks snapped up 650 metric tons of the metal last year, which is worth more than $36 billion at recent the recent price of $1,740 a troy ounce.

Overall, three quarters of all the central banks that responded to the survey thought that global bank gold holdings would increase.

The reasons for believing that this gold rush will occur are legion, but the top two are important.

Higher Risks of A Financial Crisis

The first is fear of a global financial crisis. Six out of 10 of those who responded to the survey said that was a key reason for centrals wanting to hold gold.

Negative Interest Rates A Positive for Gold

Jointly topping the list of reasons for adding gold to a country’s national reserves is the “ongoing low to negative yields in advanced economy debt,” the report states. Negative interest rates mean that investors get back less money than the price they pay for the security.

Six out of 10 respondents said that was a key reason for the central banks to add gold.

Increased Central Bank Demand Should Boost Prices

Central banks tend to buy gold when they see the opportunity to obtain the metal at a good price. In practice that means they’ll likely choose to purchase bullion on price dips. That should mean that the market will not see huge falls or plunges over the long term. Or put another way, if you are investing in gold, such as the metal held in the SPDR Gold Shares (GLD) exchange-traded fund, then the trend should be in your favour.

A minted bar (left) and a cast bar (right)

Types

Based upon how they are manufactured, gold bars are categorized as having been cast or minted, with both differing in their appearance and price.[1] Cast bars are created in a similar method to that of ingots, whereby molten gold is poured into a bar-shaped mold and left to solidify. This process often leads to malformed bars with uneven surfaces which, although imperfect, make each bar unique and easier to identify. Cast bars are also cheaper than minted bars, because they are quicker to produce and require less handling.

Minted bars are made from gold blanks that have been cut to a required dimension from a flat piece of gold. These are identified by having smooth and even surfaces.

Security features

To prevent bars from being counterfeited or stolen, manufacturers have developed ways to verify genuine bars, with the most common way being to brand bars with registered serial numbers or providing a certificate of authenticity. In a recent trend, many refineries would stamp serial numbers even on the smallest bars, and the number on the bar should match the number on its accompanying certificate.

In contrast to cast bars (which are often handled directly), minted bars are generally sealed in protective packaging to prevent tampering and keep them from becoming damaged. A hologram security feature known as a Kinegram can also be inserted into the packaging. Bars that contain these are called Kinebars.

1 oz diffractive Kinebar

Bar in protective casing

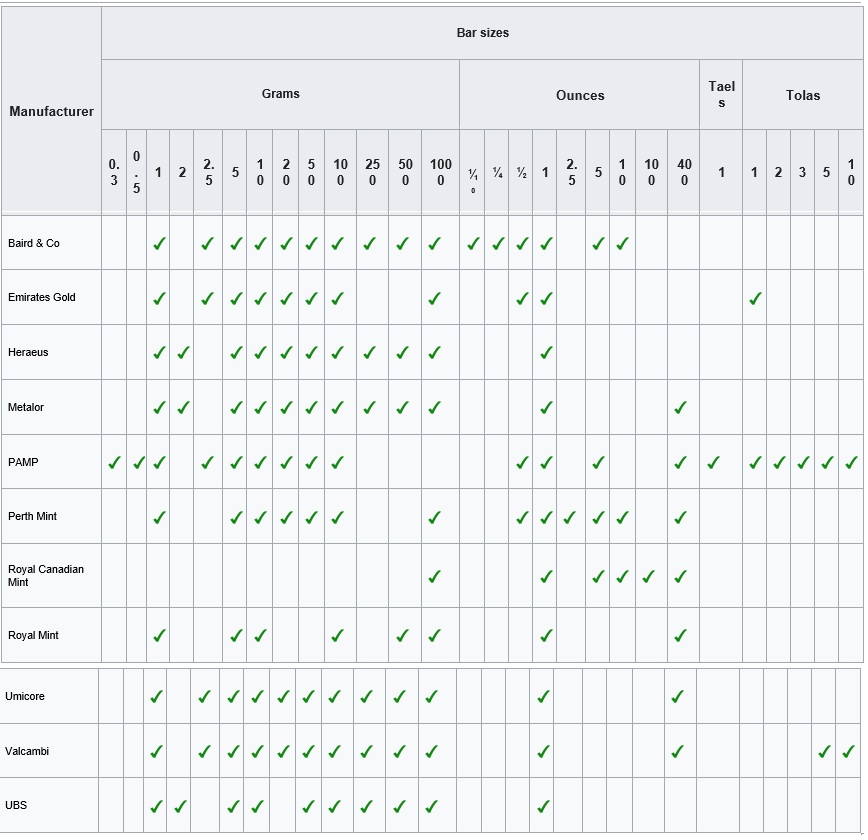

Standard bar weights

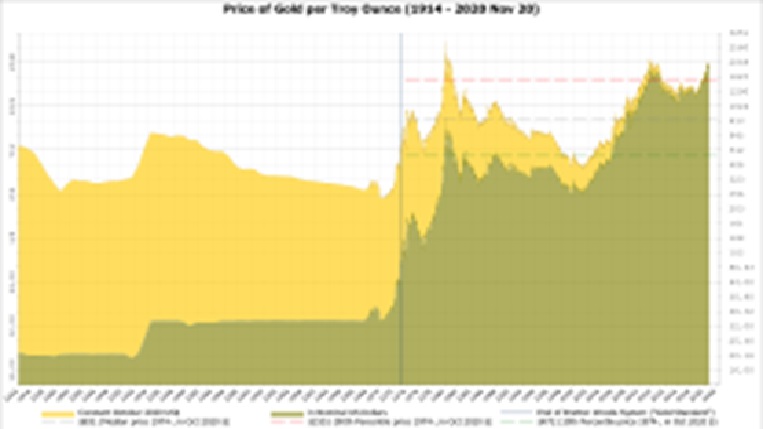

Gold prices (US$ per troy ounce), in nominal US$ and inflation adjusted US$ from 1914 onward.

Gold is measured in troy ounces, often simply referred to as ounces when the reference to gold is evident. One troy ounce is equivalent to 31.1034768 grams. Commonly encountered in daily life is the avoirdupois ounce, an Imperial weight in countries still using British weights and measures or United States customary units. The avoirdupois ounce is lighter than the troy ounce; one avoirdupois ounce equals 28.349523125 grams.

The super-size is worth more than the standard gold bar held and traded internationally by central banks and bullion dealers is the Good Delivery bar with a 400 ozt (12.4 kg; 438.9 oz) nominal weight. However, its precise gold content is permitted to vary between 350 ozt (10.9 kg; 384.0 oz) and 430 ozt (13.4 kg; 471.8 oz). The minimum purity required is 99.5% gold. These bars must be stored in recognized and secure gold bullion vaults to maintain their quality status of Good Delivery. The recorded provenance of this bar assures integrity and maximum resale value.

• One tonne = 1000 kilograms = 32,150.746 troy ounces.

• One kilogram = 1000 grams = 32.15074656 troy ounces.

• One tola = 11.6638038 grams = 0.375 troy ounces.

• One tael = 50 grams.

• TT (ten tola) = 117 grams (3.75 oz)

Tola is a traditional Indian measure for the weight of gold and prevalent to this day. Many international gold manufacturers supply tola bars of 999.96 purity.

Manufacturers

GOLD

GOLD

We are a professional team that is easy to do business with who treats all Sellers with integrity and respect. We can offer any length contract up to 3 years, with rolls and extensions.

If you have genuine gold for sale from any part of the world (including Africa, Asia, the Middle East and South America), and can bring the gold to the Zurich free zone (Kloten), we are genuine Buyers. Please see both procedures.

PROCEDURES

PROCEDURE 1

- SELLER TO SEND FCO

- BUYER TO SEND COMPANY PROFILE/ SIGN FCO

- SELLER TO SEND SPA

- BUYER TO FILL IN SPA WITH BANKING AND SIGN/STAMP

- SELLER TO COUNTER SIGN SPA

- BUYER TO OPEN BANKING FOR THE SELLER

- BUYER AND SELLER TO LODGE THE SPA IN THE SAME BANK (LEDGER TO LEDGER)

- BUYER TO SEND A BANK UNDERTAKING PAYMENT (BPU) AS A BANK GUARANTEE BY BANK TO BANK EMAIL

- SELLER TO SEND POP BY BANK TO BANK EMAIL

- SELLER TO SEND THE GOLD TO THE KLOTEN ZURICH FREE ZONE

- ONCE AUTHENTICATED AND REPORT IS ISSUED, BUYER TO PAY THE SELLER WITHIN 48 HOURS/SAME BANK INSTANT PAYMENT

- REPEAT THE SAME PROCESS AND UP THE TRANCHES

流程 1: (CHINESE)

- 卖方发出供货函

- 买方发送公司简介并签署供货函

- 卖方发送买卖合同

- 买方填写买卖合同(包括银行信息),并签署买卖合同

- 卖方签署买卖合同

- 买方为卖方开具银行账户

- 买方和卖方将买卖合同交到同一家银行(账对账)

- 买方通过银行间电子邮件发送银行承诺付款作为银行担保

- 卖方通过银行间电子邮件发送货物证明

- 卖方将黄金运送到科洛腾苏黎世自由贸易区

- 在认证报告出具之后,买方即时支付卖方款项(48小时内/同一银行)

- 重复相同的过程进行下一批次交易

PROCEDIMIENTOS 1 (SPANISH)

- VENDEDOR ENVIA EL FCO.

- OMPRADOR ENVIA EL PERFIL DE LA COMPAÑÍA

- FIRMAR FCO.

- VENDEDOR ENVIA EL SPA

- COMPRADOR LLENARA EL SPA CON INFORMACION BANCARIA CONFIRMA / Y SELLO.

- VENDEDOR CONTRA- FIRMA SPA

- COMPRADOR ABRE CUENTA PARA EL VENDEDOR

- COMPRADOR Y VENDEDOR DEPOSITAN EL SPA EN EL MISMO BANCO (DE LEDGER A LEDGER)

- EL COMPRADOR DEBE ENVIAR UN PAGO GARANTIZADO (BPU) COMO GARANTÍA BANCARIA POR CORREO ELECTRÓNICO DE BANCO A BANCO.

- VENDEDOR ENVIARÁ EL ORO A LA ZONA FRANCA DE KLOTEN ZURICH.

- UNA VEZ AUTENTICADO Y EMITIDO EL INFORME, EL COMPRADOR PAGARÁ AL VENDEDOR DENTRO DE LAS 48 HORAS / MISMO PAGO BANCARIO AL INSTANTANEO.

- REPITA EL MISMO PROCESO POR TRANCHES ADICIONALES.

PROCEDURE 1 (FRENCH)

- LE VENDEUR DOIT ENVOYER UN FCO

- L’ACHETEUR DOIT ENVOYER LE PROFILE DE L’ENTREPRISE/SIGNER LE FCO

- LE VENDEUR DOIT ENVOYER UN SPA

- L’ACHETEUR DOIT REMPLIR LE SPA AVEC LA BANQUE ET SIGNER/TIMBRER

- LE VENDEUR DOIT CONTRE SIGNER LE SPA

- L’ACHETEUR DOIT OUVRIR LA BANQUE AU VENDEUR

- L’ACHETEUR ET VENDEUR DOIVENT DEPOSER LE SPA DANS LA MEME BANQUE (LEDGER TO LEDGER)

- L’ACHETEUR DOIT ENVOYER UN ENGAGEMENT BANCAIRE DE PAIEMENT (BPU) COMME GUARANTIE BANCAIRE PAR EMAIL DE BANQUE A BANQUE

- LE VENDEUR DOIT ENVOYER UN POP PAR EMAIL DE BANQUE A BANQUE

- LE VENDEUR DOIT ENVOYER L’OR A LA ZONE LIBRE DE KLOTEN ZURICH

- UNE FOIS AUTHENTIFIE ET LE RAPPORT EMIS, L’ACHETEUR DOIT PAYER LE VENDEUR DANS LES 48 HEURES. MEME BANQUE, PAYMENT INSTANTANE.

- REPETEZ LE MEME PROCESSUS ET DANS LES TRANCHES

PROCEDURE 2

- SELLER TO SEND FCO.

- BUYER TO SEND COMPANY PROFILE AND SIGN THE FCO.

- SELLER TO SEND SPA. (INCLUDING BANKING, PASSPORT COPY AND COMPANY LICENCE CERTIFICATE)

- BUYER TO FILL IN SIGN THE SPA. (INCLUDING BANKING, PASSPORT COPY AND COMPANY LICENCE CERTIFICATE)

- SELLER TO COUNTER SIGN SPA.

- BUYER AND SELLER TO LODGE THE SPA IN THEIR BANK.

- BUYER TO SEND A BANK GUARANTEE OR BANK PAYMENT UNDERTAKING TO THE SELLER’ S BANK. (BY BANK TO BANK EMAIL COMMUNICATION ONLY NO SWIFTS)

- SELLER TO SEND POP TO THE BUYER’ S BANK. (BY BANK TO BANK EMAIL COMMUNICATION ONLY NO SWIFTS)

- SELLER TO SEND THE GOLD TO THE KLOTEN ZURICH FREEZONE.

- ONCE AUTHENTICATED AND REPORT IS ISSUED, BUYER TO PAY THE SELLER WITHIN 48 HOURS. (BANK TO SEND A PAYMENT CONFIRMATION RECEIPT TO THE SELLER’ S BANK)

- REPEAT THE SAME PROCESS AND UP THE TRANCHES.

流程 2: (CHINESE)

- 卖方发出供货函

- 买方发送公司简介并签署供货函

- 卖方发送买卖合同(包括银行信息,护照复印件和公司证照)

- 买方填写并签署买卖合同(包括银行信息,护照复印件和公司证照)

- 卖方签署买卖合同

- 买方和卖方把买卖合同交到各自的银行

- 买方向卖方银行发出银行担保或银行承诺付款(通过银行间电子邮件沟通,无SWIFTS)

- 卖方将货物证明发送到买方的银行(通过银行间电子邮件沟通,无SWIFTS)

- 卖方将黄金发送到科洛滕苏黎世自由贸易区

- 在认证报告出具之后,买方将在48小时内付款给卖方(买方银行将付款确认收据发送给卖方银行)

- 重复相同的过程进行下一批次交易

PROCEDIMIENTOS 2 (SPANISH)

- VENDEDOR ENVIA FC. (PROPUESTA. CORPORATIVA. FORMAL)

- EL COMPRADOR DEBE ENVIAR EL PERFIL DE LA COMPAÑÍA Y FIRMAR EL FCO. (PROPUESTA. CORPORATIVA. FORMAL)

- EL VENDEDOR ENVIARÁ EL SPA ACUERDO DE COMPRA VENTA. (INCLUYE INFORMACION BANCARIA, COPIA DEL PASAPORTE Y CERTIFICADO DE LICENCIA DE LA COMPAÑÍA)

- EL COMPRADOR DEBE LLENAR / FIRMAR EL SPA. (ACUERDO DE COMPRA VENTA, INFORMACION BANCARIA COPIA DEL PASAPORTE Y CERTIFICADO DE LICENCIA DE LA COMPAÑÍA).

- VENDEDOR CONTRA FIRMA SPA. (ACUERDO DE COMPRA VENTA)

- COMPRADOR Y VENDEDOR DEPOSITARAN EL SPA (ACUERDO DE COMPRA VENTA) EN SU BANCO.

- EL COMPRADOR DEBE ENVIAR UNA GARANTÍA BANCARIA O UN COMPROMISO DE PAGO BANCARIO (BPU) AL BANCO DEL VENDEDOR (POR CORREO ELECTRÓNICO DE BANCO A BANCO (SOLAMENTE SIN SWIFTS)

- EL VENDEDOR ENVIARÁ POP (PRUEBA DE PRODUCTO) AL BANCO DEL COMPRADOR. (POR CORREO ELECTRÓNICO DE BANCO A BANCO SOLAMENTE SIN SWIFTS)

- EL VENDEDOR ENVIARÁ EL ORO A LA ZONA FRANCA DE KLOTEN ZURICH.

- UNA VEZ AUTENTICADO Y EMITIDO EL INFORME, EL COMPRADOR PAGARÁ AL VENDEDOR DENTRO DE LAS 48 HORAS. (EL BANCO ENVIARÁ UN RECIBO DE CONFIRMACIÓN DE PAGO AL BANCO DEL VENDEDOR) (EL BANCO ENVIARÁ UN RECIBO DE CONFIRMACIÓN DE PAGO AL BANCO DEL VENDEDOR)

- REPITA EL MISMO PROCESO EN TRANCHES ADICIONALES.

PROCEDURE 2 (FRENCH)

- LE VENDEUR DOIT ENVOYER UN FCO.

- L’ACHETEUR DOIT ENVOYER LE PROFILE DE LA COMPANIE ET SIGNER LE FCO.

- LE VENDEUR DOIT ENVOYER UN SPA

- L’ACHETEUR DOIT REMPLIR ET SIGNER LE SPA (Y COMPRIS BANQUE, COPIE DE PASSPORT ET CERTIFICAT DE LICENCE D’ENTREPRISE)

- LE VENDEUR DOIT CONTRE SIGNER LE SPA

- L’ACHETEUR ET VENDEUR DOIVENT DEPOSER LE SPA DANS LEUR BANQUE.

- L’ACHETEUR DOIT ENVOYER UNE GARANTIE BANCAIRE OU UN PAYMENT BANCAIRE S’ENGAGEANT A LA BANQUE DU VENDEUR (COMMUNIQUANT UNIQUEMENT PAR EMAIL DE BANQUE A BANQUE (PAS DE SWIFTS)

- LE VENDEUR DOIT ENVOYER UN POP A LA BANQUE DE L’ACHETEUR (COMMINIQUANT UNIQUEMENT PAR EMAIL DE BANQUE A BANQUE. (PAS DE SWIFTS)

- LE VENDEUR DOIT ENVOYER L’OR A LA ZONE LIBRE DE KLOTEN ZURICH

- UNE FOIS AUTHENTIFIE ET LE RAPPORT EMIS, L’ACHETEUR DOIT PAYER LE VENDEUR DANS LES 48 HEURES. (LA BANQUE DEVANT ENVOYER UN RECU CONFIRMANT LE PAYMENT A LA BANQUE DU VENDEUR)

- REPETER LE MEME PROCESSUS ET DANS LES TRANCHES.

POP TO INCLUDE:

- Certificate of Assay Report

- Certificate of Ownership

- AIR WAYBILL

- Commercial Invoice

- Tax certificates

- Import-Export license

- Certificate of Origin

- Warehouse receipt and list of products

- Customs Clearance Certificate

SPA: SALES PURCHASE AGREEMENT, 买卖合同, ACUERDO DE COMPRA VENTA, CONTRAT D’ACHAT/VENTE,

FCO: FORMAL CORPORATE OFFER, 卖方供货函, PROPUESTA CORPORATIVA FORMAL, OFFRE D’ENTREPRISE FORMELLE,

Encore Tissue are a family business with over 20 years experience in paper manufacturing.

Encore Tissue are a family business with over 20 years experience in paper manufacturing.

The MERINO™ EARTHWISE range is made from 100% recycled clean office waste paper, reducing paper going to landfill.

The MERINO™ EARTHWISE range is made from 100% recycled clean office waste paper, reducing paper going to landfill.

MERINO™ EXECUTIVE range is the ideal solution for establishments not only requiring their toilet tissue and towel to be aesthetically pleasing in their washroom, but to be the perfect combination of luxuriously soft, premium quality and superior wet strength.

MERINO™ EXECUTIVE range is the ideal solution for establishments not only requiring their toilet tissue and towel to be aesthetically pleasing in their washroom, but to be the perfect combination of luxuriously soft, premium quality and superior wet strength.

MOCCONA COFFEE

MOCCONA COFFEE BRAND: ANTONA OLIVE POMACE OIL 4L

BRAND: ANTONA OLIVE POMACE OIL 4L SENSITIVE SKIN BABY WIPES

SENSITIVE SKIN BABY WIPES We source and wholesale the meat of Australian producers who stand by their products, many of our meats brands are awarded, feted, desired and trusted. We are dedicated to sourcing the best & premium meat products for our customer’s needs from producers whom we believe have a real understanding of quality and consistency.

We source and wholesale the meat of Australian producers who stand by their products, many of our meats brands are awarded, feted, desired and trusted. We are dedicated to sourcing the best & premium meat products for our customer’s needs from producers whom we believe have a real understanding of quality and consistency.

We offer our clients a wide selection of smallgoods sourced from respected Australian producers who are passionate about the ingredients, the taste and the quality of their products.

We offer our clients a wide selection of smallgoods sourced from respected Australian producers who are passionate about the ingredients, the taste and the quality of their products. We have been supplying quality Australian game and venison to the hospitality & catering sectors for years – chefs and gourmet food lovers have enjoyed the difference these meat options bring to the table.

We have been supplying quality Australian game and venison to the hospitality & catering sectors for years – chefs and gourmet food lovers have enjoyed the difference these meat options bring to the table.

ORIGINAL SPRINGS (SPRING WATER)

ORIGINAL SPRINGS (SPRING WATER)

PRODUCT SIZE: 325 ML GLASS BOTTLE

PRODUCT SIZE: 325 ML GLASS BOTTLE PRODUCT SIZE: 325 ML GLASS BOTTLE

PRODUCT SIZE: 325 ML GLASS BOTTLE